CIF Incoterms Explained: (in 5 Steps)

Importing/exporting products by water?

If so, keep reading. We’ll discuss an incoterm related to “waterway” transport.

It’s important for all businesses to know, especially if they get their supply by water.

That would be CIF incoterms, which translates to (Cost, Insurance, and Freight).

First – How CIF Incoterms Term is Used.

As mentioned before, CIF is an incoterm.

Developed by the ICC, incoterms are categories that classify shipments. And they do so based on “buyer and seller” responsibilities.

They describe who pays for what, and the liabilities/documents required by each.

The 13 Incoterms.

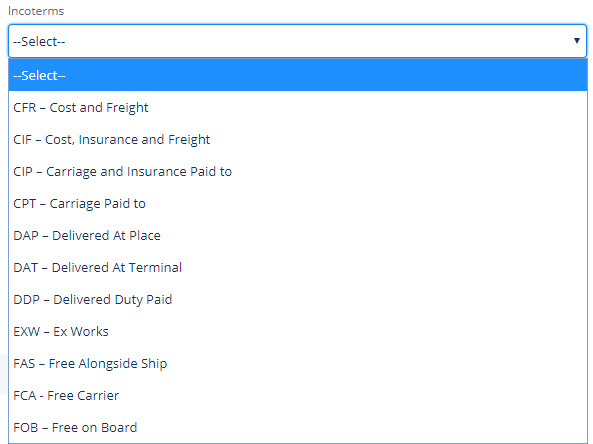

Yes, there are 13 incoterms of them. They’re updated every decade or so.

Those 13 terms are divided into 2 types. Those being…

- Rules for all transport modes.

- Rules for waterways only (inland and sea).

The later includes 4/13 terms. And CIF incoterm is one of them.

So if your shipping schedules are land-based only, CIF doesn’t concern you.

Second – What Does CIF Mean?

It stands for (Cost, Insurance, and Freight).

The previous terms outline seller responsibilities when shipping products.

The sellers pays costs, insurance, and freight compensation, while items are in transit to buyer.

After the item reaches the buyer’s port (import point), responsibility shifts to them.

In a sense, CIF classifications evenly divide shipment responsibilities. And it’s less extreme than other incoterm classifications.

Third – Seller Obligations With CIF Freight.

Let’s explain this with a concept.

In any shipment process, there’s a set of travel checkpoints. From start to finish, those are…

- Warehouse origin (at seller).

- Export Customs – Port of export (at seller).

- Port of import – Import Customs (at buyer).

- Final destination (at buyer).

With CIF, sellers are only responsible for the first two parts.

They’re responsible for the costs, insuring the packages, loading/unloading, etc.

One More Thing – Insurance.

It’s the ONLY difference between CIF and “CFR” (another waterway incoterm).

If the item gets damaged onboard, there’s compensation. This usually isn’t the case with normal shipments.

Fourth – Buyer Obligations With CIF Shipping Terms.

Check the previous point. Look at the checkpoints we mentioned.

After the package reaches the “second port,” the buyer takes over. They must unload, and drive the package back to the final destination.

Now, this seems like a suitable arrangement for buyers. After all, sellers take care of costs. Also, they pretty much ship everything to port…

But that doesn’t make CIF shipping terms the best option for buyers.

Control Problems.

With CIF, buyers lack half the responsibility. Therefore, they lack half the control.

Buyers can’t pick shipping schedules. They also can’t pick shipping companies. Nor do they inspect/handle items half the way through.

And let’s not forget insurance issues.

If an item arrives damaged, a seller should reimburse the buyer. And the seller in-turn is reimbursed by the insurance company.

So while CIF forces insurance on packages – it doesn’t specify who the payout goes to.

In most cases, it’s the seller. And buyers receiving damaged goods need to contact sellers for their compensation.

And as is known, this can involve many delays, “proof of damage,” customer service issues, etc.

Fifth – Who Uses CIF Incoterms?

Many sellers do so. But it’s used with “less protected” and “expensive but delicate” items.

Lesser Protection.

Sometimes, sellers will ship items as non-containerized.

This means they aren’t stored inside the ship. Instead, they’re stored directly on the deck. Thus, they’re more exposed to damage.

The damage might be environmental, accidental or mishandling related.

With lesser protection comes the need for insurance. For that reason, CIF is an option.

But Why Not Ship “Containerized”?

Sometimes, this is not possible.

Some sellers manufacture large products. Examples include automobiles, large machinery, large construction equipment, etc.

Such items don’t fit in containerized warehouses. They mostly fit on-deck, where there’s more space.

Easily Damaged.

Sometimes, sellers ship CIF. And they containerize, but still pay for insurance…

They mainly do so to “private consumers.”

For example, if a business is selling “massage chairs” at $3000, expect it to be insured. This is necessary for the seller’s reputation, and to convince consumers of buying expensive products.

That’s for Sellers. What About Buyers?

Buyers use CIF too. But they’re used mainly businesses (sometimes private consumers).

As mentioned before, certain industries necessitate CIF. They include anything with large item shipments.

In those cases insurance becomes vital. And CIF becomes an option for both sides!