What is Incoterms?

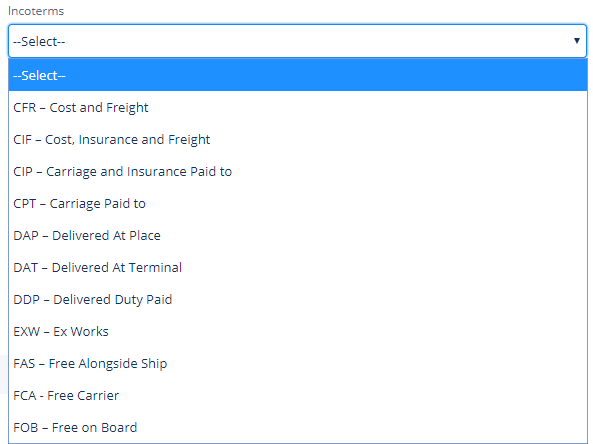

Terms FCA, DAP, DDP. EXW, CIF, CIP, CFR, CIP and more!

Shipping Incoterms Explanation

Incoterms is more of an abbreviation that stands for International Commercial Terms. Anyone who has indulged in international trade will admit that this is a very vital term. It represents a useful way of communication. Therefore, it helps to reduce any confusion that may arise between the sellers and buyers.

That being said, an incoterm is like a universal representation. Is used to define a transaction between the exporter and the importer. This helps both parties to understand the costs, risks, logistics, and transportation management. Also the responsibilities of products right from when they are loaded at the sellers dock. Until they are received at the buyer’s importing country.

Incoterms involve all possible ways that can be used in the distribution of the responsibilities. It protects the obligations between the two involved parties. This is because it is always necessary to pre-define the obligations and responsibilities. It must be done for the transportation of the products before making the trade.

Such obligations and responsibilities include:

The Point of Delivery:

- this is defined by the Incoterms as the delivery point from the seller to the buyer. Delivery, indicates the point at which the responsibilities and risks are transferred from the seller to the buyer. Hence, point of delivery incoterms simply define the point of risks transfer.

Import and Export Formalities:

- The Incoterms outlines the party that arranges for the formalities used in importation and exportation.

The Insurance Costs:

- Also, the Incoterms are designed in order to outline who happens to bear the costs for insurance. The cost of insurance must be pay between the seller or the buyer.

The Transportation Costs:

- The Incoterms define the party that will pay for the costs of transportation of goods. In most cases, there can be more than a single means of transportation involved. Hence Incoterms are used to define which party pays for which mode of transportation. Where sea transportation is involved, the Incoterms outline which party will be the shipper of those goods.

Incoterms Definition and Everything you need to Know about

It’s funny how, despite freight shipping being such an integral part of our everyday lives. Most people still know very little about it. Or worse, they know nothing about these jargons that are associated with it. Taking for instance incoterms. They are definitely one of the most important features for any international trade. Yet still, one of the most misunderstood terms that have confused the new international traders for years now.

It’s without a doubt that incoterms have become such a vital part of our everyday language of international trade. Incoterms have been incorporated in international goods and services sales contracts. Above all, to provide guidelines for the exporters, importers, lawyers, transporters, as well as the insurers.

For that reason, this guide is designed to provide you with comprehensive information about incoterms. In order to give a better understanding of the same all terms are listed here.

The Incoterms 2010: The Current Incoterm Set

Incoterm 2010 consists of 11 terms of trade which are subdivided into two categories. The first category can be used with any mode of transportation. And the other one is used with only sea shipments. In 2018, the entire world is using the ICC’s set of 2010 Incoterm rules in the different operations. Before the 2010 incoterms, the most recent of them all was Incoterms 2000.

The major change that was made from the Incoterms 2010 was the elimination of the following terms:

- DAF (Delivered at Frontier),

- (DEQ) Delivered Ex Quay,

- (DDU) Delivered Duty Unpaid, and the

- (DES) Delivered Ex Ship.

Therefore, from the year 20110 to date, the Incoterms 2010 have been the operational Incoterms.

The Incoterm 2010 Rules Requirements

This requirements needs to be observed before a contract is signed and concluded. This includes:

- Specifying the place of departure. For the goods in the most precise way possible. This helps to avoid possible disputes that involve ambiguity of the place.

- The specific Incoterm that has been used should be included in the contract of sale. The contract must be sign by the two parties involved. Incoterms only apply if they are mentioned in the contract.

- Choosing of the appropriate Incoterms. When choosing the Incoterms, they should be appropriate. Is for the goods CBM in terms of weight, size, and type. Choosing the wrong incoterm could be quite costly

- It’s important to note that the rules offered by the Incoterms do not give a complete contract of sale. Ensure that in case they are any other contractual obligations, they are incorporated separately. For instance the terms of payment.

The Incoterms, Brief Definition and Differences of Each

EXW Incoterms: Ex-Works

Ex-Works defines majorly the place of delivery. In this case, the seller makes the goods available at the place of delivery. Then the buyer is responsible for clearing and loading the goods for transportation.

Also, the buyer is responsible for preparing the export documentation as well as getting these goods through the customs. The term EXW is used often when making the initial quotation for sale of goods without including any costs. In the Ex-Works, the seller has the least possible responsibilities.

While using EXW, there might be some practical difficulties which may arise especially when it comes to the cross-border trades. The difficulties include the inability for the buyer to arrange for the formalities used in exportation.

DDP incoterms: Delivery Duty Paid

With the DDP, the seller happens to be responsible for delivering the goods to the buyer’s country. More like the opposite version of the Ex-Works. Also, the buyer gets to pay for all costs which are associated with bringing the goods to the buyer’s final destination. Inclusive costs are the import taxes and duties.

The Delivery Duty Paid (DDP) places the maximum obligations on the seller. Although the seller is not responsible for the unloading of these goods. The seller transports the goods to the named buyer location. It covers the insurance and transportation costs, then the remaining risk is transferred to the buyer.

However, just like in the EXW, there could be some practical difficulties especially when it comes to the cross border assignments. The seller is required to clear the import formalities. But this will be quite a hassle to the seller. In such a case may be because lacking in local knowledge for clearing formalities used in importation. Most of the time a freight forwarder is used.

FCA Incoterms: The Free Carrier

With FCA incoterms, the seller gets to deliver the goods that have been cleared for export to whatever carrier the buyer would like to use. Or better still, to whatever place the two parties have agreed upon. The agreed-upon place determines the responsibilities of both the sellers and the buyers.

In that; if the delivery occurs at the premises of the seller they are deemed responsible for the loading of these goods. However, if the loading of these goods occurs in a different location. Then the loading is no longer the seller’s responsibility. The buyer is supposed to arrange for all modes of transport that will be used and also pay for export and import costs.

FOB Incoterms: Free on Board

This term is used to set up a situation where the seller has the responsibility to advance the government tax to the country of origin as a commitment to load the goods on a vessel that’s the buyer’s choice. And once the goods get on the carrier, the responsibilities are then divided into two parties. The seller gets to pay for the loading costs and the transportation of goods. Also, they get to clear the goods for export.

As soon as the goods are transferred to the buyer’s account, the risks are then transferred to the buyer. Therefore, it becomes the buyer’s responsibility to clear the goods for import. FOB is used exclusively for sea transport.

CFR Incoterms: Cost and Freight

With the CFR, the seller gets to pay for the cost as well as the freight in order to bring the goods to the destination port. However, as soon as the goods get on to the vessel, all the risks are then transferred to the buyer. And this is what differentiates the CFR from FOB.

It’s important to note that when a party arranges for the transportation, it does not necessarily mean that the risks involved are with that particular party that’s arranging for the transportation. In the CFR case, the seller happens to be the one who arranges for the main transportation of these goods.

CIF Incoterms: Cost Insurance and Freight

CIF is quite similar to CFR but only with a slight difference. In that, in CIF there happens to be an addition of the insurance. The risk is passed on by the buyer from the seller. This happens as soon as the shipment gets loaded on to the carrier. However, the seller is also responsible for arranging for this carrier. Since in this case, the seller happens to be the shipper.

In addition to that, the seller is required to pay for insurance. The insurance will cover for the risks that may affect the buyer during the transit. Also, the seller may opt to have another insurance that will cover his own obligations too. The buyer has the option of going for extra insurance if they wish to.

FAS Incoterms: Free Alongside Ship

Well, this term is just as simple as it sounds. In this case, the seller gets to deliver the goods to their buyer. All the goods are required to be shipped alongside the buyer’s ship. Therefore, the risk is passed on from the seller on to the buyer. As soon as the goods in transit are exported alongside the ship.

As soon as the goods are goods are delivered for shipment. All risks and responsibilities are transferred to the buyer. This includes the potential damage or loss of these goods. However, the seller will be responsible for the clearance of these goods at the export. The buyer, on the other hand, is responsible for insurance costs.

CPT Incoterms: Carriage Paid To

With the CPT the seller gets to pay for the carriage. So that he can present the shipment to the specific agreed upon location with the buyer. All in all, the risks are passed on to the buyer as soon as they are delivered to the main carrier.

As discussed earlier, the fact that the party is arranging for the carrier. This doesn’t necessarily mean that the risks are all upon them. In this case, although the seller is responsible for arranging for the carrier, at this point the risk is already passed on to their buyer.

CIP Incoterms: Carriage and Insurance Paid

The seller is responsible for paying for the carriage as well as the insurance to the agreed point of delivery. However, once the goods are handed over to the carrier, the risks are all transferred to the buyer.

This happens to be a very common, especially when it comes to intermodal deliveries. The responsibility will mostly be with the buyer. But when it comes to insurance and transportation costs, it will majorly be on the seller.

DAP Incoterms: Delivered at Place (DAP)

When DAP is use it means that the seller gets to make deliveries. When the goods get to their final destination and it’s all ready for offloading. Also, the seller gets to bear all risks and costs that have been incurred. The responsibility of the seller is to bring the shipment to this location successfully.

The buyer handles only the costs of offloading and importing the fees.

Delivered at Terminal (DAT)

DAT outlines a situation where the seller gets to cover for almost entirely all costs that are incurred during shipment. This includes the insurance costs, export fees, the carriage as well as the port charges at the destination.

In this situation, the seller’s responsibility is delivering the goods to the agreed location and loading them. However, the seller doesn’t have to incur costs for clearing goods for import.

Common Issues associated with the use of Incoterms Contracts

- Most people are more likely to use CIF or FOB. Typically when the goods need to be consigned by road or air.

- Involved parties taking on more responsibilities than the term requires them. E.g.: loading when under the Ex-works Incoterm.

- Use of outdated Incoterms.

- Failure to quote the Incoterms in the contracts. This makes it quite a hassle to assign obligations to sellers and buyers as well as manage the contracts.

- Incorrect abbreviation of the Incoterm being quoted.

- Parties choosing the wrong Incoterm for their particular type of trade.

- Failure to consider the mode of transport before choosing a certain Incoterm.

- Conservatism: where sellers may be resistant to change even after the Incoterms have been updated.