Introduction to HTS Codes

HTS codes, also known as Harmonized Tariff Schedule codes, are instrumental in international trade. These unique identification numbers are crucial for categorizing goods in global commerce. This comprehensive guide aims to demystify HTS codes and explain their critical role in the import and export processes.

What is an HTS Code?

An HTS code is a 10-digit number used worldwide to classify traded products. Developed by the World Customs Organization (WCO), these codes help in identifying the type of goods, determining tariff rates, and ensuring compliance with international trade regulations. They are essential for businesses involved in international trade to understand and accurately use these codes to avoid legal issues and streamline customs processes.

The Structure of HTS Codes

The HTS code structure is hierarchical. The first six digits are harmonized globally, known as the HS (Harmonized System) code, which classifies goods in a standardized manner. The subsequent digits are country-specific, providing further detail and allowing countries to impose different tariff rates.

Why HTS Codes Matter

Accurate HTS classification is vital for complying with international trade laws. Misclassification can lead to severe penalties and delays in goods clearance

HTS codes directly influence the tariff rates applied to goods. Correct classification ensures businesses are not overpaying or underpaying tariffs.

HTS codes provide valuable data for analyzing trade patterns, market research, and making informed business decisions.

A universal system like HTS codes simplifies and standardizes the process of importing and exporting goods, making global trade more efficient.

Best Practices for Using HTS Codes

- Regular Updates: HTS codes are updated periodically. Businesses should stay informed about these changes to ensure continued compliance.

- Professional Consultation: Consulting with customs brokers or trade compliance experts can help in accurate HTS classification.

- Detailed Product Descriptions: Providing detailed and accurate product descriptions helps in determining the correct HTS code.

Why Choose Us

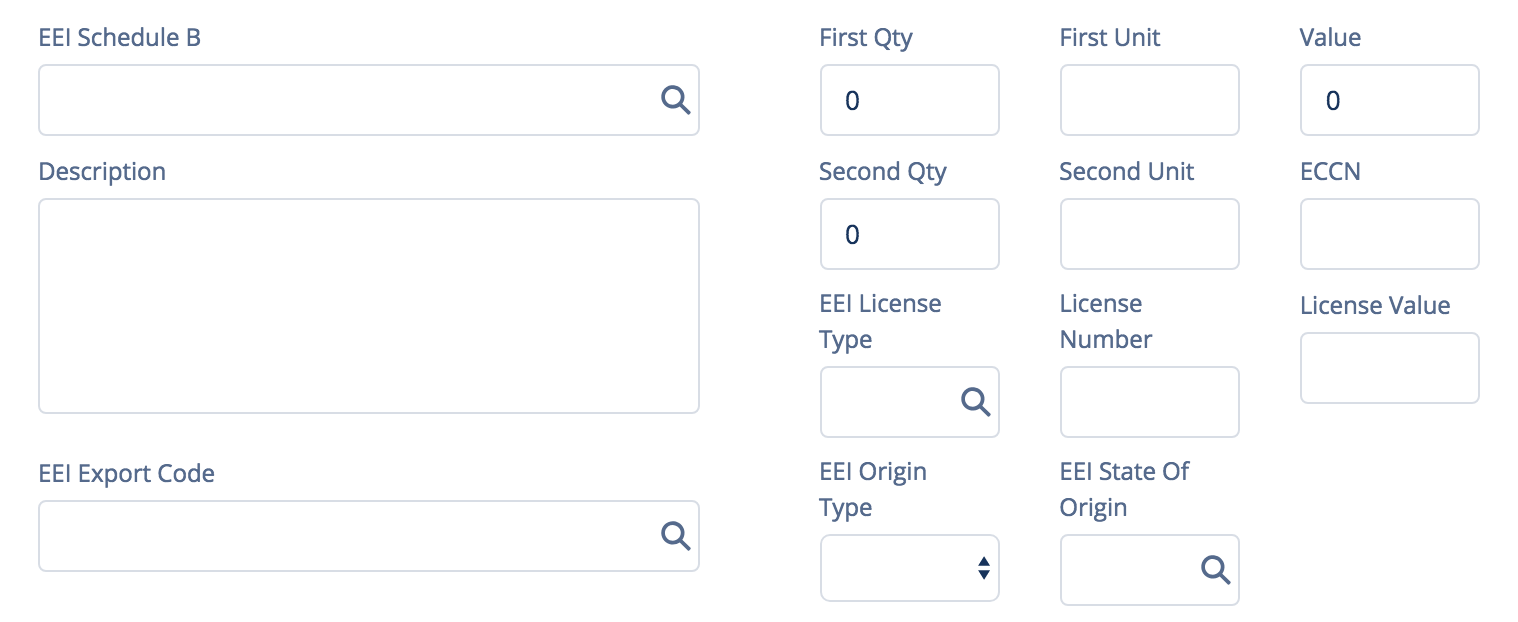

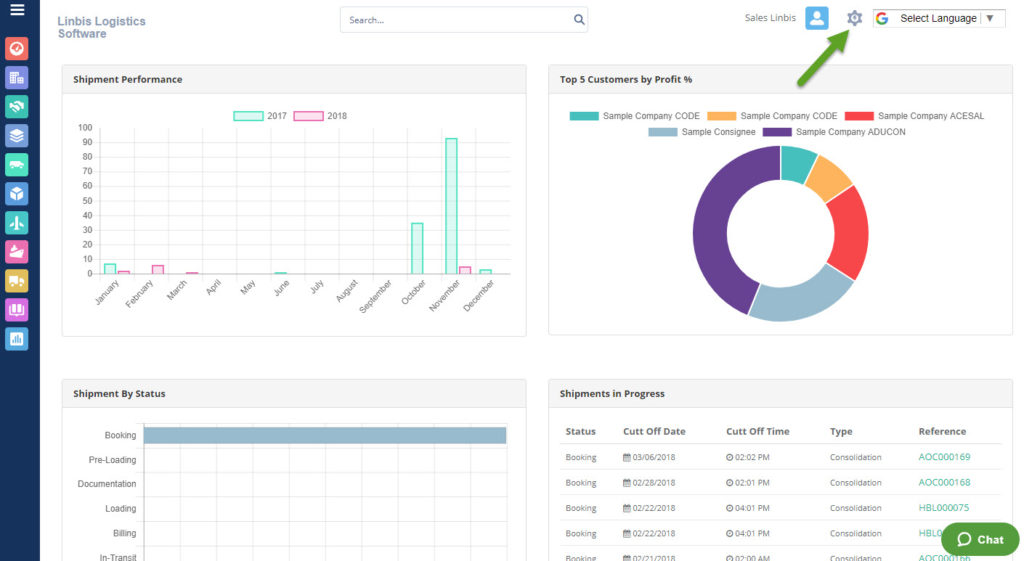

The Role of Linbis Logistics Software in HTS Code Assignment

HTS codes are essential in the realm of international trade, and logistics software like Linbis plays a crucial role in ensuring these codes are accurately and efficiently assigned. For logistics companies and importers, leveraging such software is not just about compliance; it’s about gaining a strategic advantage in the complex world of global trade.

Logistics software like Linbis simplifies the process of finding and assigning the correct HTS codes. It offers a user-friendly interface and a comprehensive database that helps businesses classify their goods accurately and efficiently.

These software solutions often integrate with global trade databases, ensuring that users have access to the latest HTS code information, which is essential for compliance and accurate tariff calculation.

Logistics software provides tools for automated compliance checks, reducing the risk of errors in HTS code assignment and ensuring adherence to international trade regulations.

By facilitating the quick and accurate assignment of HTS codes, logistics software like Linbis makes the import/export process more efficient, saving time and reducing costs for logistics companies and importers.

HTS Code Harmonized Tariff Codes

Harmonized tariff codes (HTS Code) are part of an internationally-standardized system that allows countries to track and quantify products being shipped and imported.

The World Customs Organization (WCO) developed the harmonized schedule for better international classification of shipped items. Each country has their own specific harmonized codes, making it easy to track the imports of a specific country.

Understanding the difference in harmonized codes provides a solid grasp of international shipping classification methods.

Below, we will examine two harmonized tariff codes, HTS and HS. Our comprehensive guide will showcase the differences between these two commonly-used codes. As well as highlight their uses in international shipping.

HTS Codes

HTS codes are ten digits and provide country-specific information regarding an order. Starting with the seventh digit, HTS codes each offer differing sequences. This depends on both the type and country of the shipment. Of note: the term “HTS code” refers to US-based codes. Other countries may have their own name for the codes.

These codes are not selected at random. Instead, they are assigned based on the Harmonized Tariff Schedule of the import country. If the US were to import steel for instance, the HTS code would reflect that of the United States’ Harmonized Tariff Schedule.

These codes must be included on all international shipments—and for good reason. The most important of which may be that tariff codes actually provide the tariff rate for the product being imported. By having access to a product’s HTS code, governments can instantly locate the tariff and duty rates on a particular good and charge it accordingly.

But that’s just one use of HTS codes. Governments also use them to track critical import and export data to get a better understanding of their countries’ trade practices and standing. With HTS codes, any given country can instantly track and record data regarding specific products with specific countries, including: item weight, shipment origin or destination, tariffs and price, etc.

In this way, HTS codes quantify both the value and the importance of each shipment made and provide crucial economic insight into world trade statistics.

The Structure of HTS Codes

The ten-digit sequence of an HTS code can be broken down into five separate sections. Each component of the HTS code contains specific information regarding the shipment. It’s this combined information that helps governments track the statistics of international trade.

Each section of the HTS code is composed of two numbers, and by understanding their importance, you, too, can learn to read HTS codes.

Let’s take a look below at the five sections of an HTS code. While doing so, consider the following example HTS code of 7302.01.1045. Notice the make up and composition of the code and refer back to it as we dissect its different components below:

Tariff Codes Structure

- Chapter—The first two numbers in an HTS code sequence identify the shipment’s chapter. Chapters start with 01 and end at 99, with each one corresponding to a different category of shipments.

Chapter 01, for instance, indicates that the shipment contains live animals. In contrast, an HTS code beginning with the numbers “73” reflect that the shipment is one of “Articles of Iron or Steel.”

- Heading—The next pair of numbers in the HTS code sequence reflect the heading under which your shipment may be classified. Each chapter of international shipments includes headings that provide more specific information about the product being shipped.

Let’s consider our Chapter 73 example once more. We know that an HTS code beginning with 73 indicates that the shipment contains “articles of iron or steel,” but what would an HTS code mean if it began with 7302?

In this case, “02” serves as the heading of the HTS code. By looking up the code—more on this later—you will find that heading 02 indicates that the shipment contains not just articles of iron or steel, but “Railway or Tramway Track Construction Material of Iron or Steel.”

How to determine HTS Code

This is quite an important distinction when determining the duty or tariff to be charged—and for statisticians to keep in mind when compiling and tracking data.

- Subheading– As you can notice in the example code above, a period is placed after the chapter and heading before being followed by the subheading. The subheading is offset by periods on either side and offers more-specific context about the nature of the shipment. The subheading designates the shipment as being of a specific class of product within its specific chapter and heading.

Can you spot the subheading in our example above? Right, it’s “02.” And in our case, this particular subheading refers to a classification of steel shipments relating to “Railway Or Tramway Rails Of Iron Or Steel.”

Based on this information, many useful details start to become apparent. Now, we have a pretty clear picture of the content being shipped and of its eventual use or purpose. A general idea of the tariff can be formed—though nothing exact yet—as those knowledgeable in the area can have a rough understanding of imposed duties. This, of course, remains country specific.

- Second subheading—How, exactly, does the HTS code provide officials with the tariff and duty rate for a given product?

Through the second subheading.

As you may have noticed, so far each segment of the HTS code has provided for more specific information regarding the kind of shipment being made; however, none have provided any precise measurements on the financial aspect of the shipment.

The second subheading is different.

Unlike other sections of the HTS code, the second subheading deals strictly with the tariff rate itself and does nothing to define the contents of the shipment in an obvious identifying manner.

This distinction can be perfectly realized through the example HTS code provided above. The second subheading—in this case “10”—determines the duty on all “Railway or Tramway Rails of Iron or Steel.”

However, several subsections of these items still exist, and determining the exact nature of the shipment can only be made through the use of the Statistical Suffix.

- Statistical Suffix—The Statistic Suffix is the final two-digit series in the HTS code, and it provides the remaining information required to understand the exact nature of a shipment. The Statistical Suffix provides a variety of distinction between products that are shipped under specific headings and subheadings and allows officials to know exactly what is being imported (or exported).

The Statistical Suffix in our example above is “45.” In order to understand the importance of this series, consider the difference between our HTS code—7302.10.1045 (Other Rails, New, Of Iron Or Nonalloy Steel, Heat Treated, Over 30 Kg Per Meter)—and the code 7302.10.1045 (Other Rails, New, Of Iron Or Nonalloy Steel, Heat Treated, Not Over 30 Kg Per Meter).

As you can see, the only difference between the two shipments here is the weight of the product provided.

While it often does provide the weight of the item being shipped, the Statistical Suffix is not limited to this aspect in identifying shipments.

HTS Code Lookup

Now that you have an understanding of each component of the HTS code, you are ready to look up and read specific codes.

This can be done easily online through websites that will provide an organized list of different HTS codes.

A list of the United States’ tariff schedule may be found online at https://hts.usitc.gov/. This government website offers a user-friendly platform that supports both HTS code searches and general look-ups.

This means that it’s a powerful tool to use whether you need to search a specific code using the site’s search function or if you want to do a manual lookup or some research with its listed HTS code values.

What is the HS Code?

Unlike HTS codes, HS codes provide a universally-recognized method of classifying and identifying international shipments. Crucial to the import and export business, HS codes are six digits and length and do not provide the same country-specific information found in HTS codes.

All international harmonized tariff schedule codes include an HS code. In fact, an item’s specific HS code makes up the first six digits of every HTS code.

Consider our HTS code example above: 7302.10.1045.

In this example, the first six digits—7302.10—constitute the item’s HS code. Developed by the World Customs Organization and adopted in the 1920s. HS codes are recognized by more than 200 countries as a standardized import and export classification system. HS codes arose as a method to combat the difficulties of international trade between countries that did not share a common language. Because the code is numerical, it can be read and understood by governments world over. Therefore the code’s 99 chapters can be translated and understood in each country respectively.

HS Code Lookup

As is the case with HTS codes, several online sites offer the capability to search HS codes. These online search platforms give easy access to vital international shipping information.

HS codes can be found through the same US government website linked above for HTS codes, as all 99 chapters are enumerated on the site. However, keep in mind that the first six digits only of the HTS codes provided represent the products HS code.

For those looking to search just a shipment’s HS code, other sites may be of more use. https://www.foreign-trade.com/reference/hscode.htm, for example, provides a simple and effective HS code search option that won’t bog users down with unnecessary information.

HTS Code vs HS Code

As noted, HTS and HS codes, though related, differ in important ways.

Namely, the HS code provides the backbone of the HTS code with its universally-recognized method of shipment classification and identification.

The HTS code is a US-specific code that determines the tariff and duty of a certain shipment. While providing additional identifying information about the product.

Each country has its own version of an HTS code while no country has its own HS code.

Remember: HTS codes are determined in part by the country of import. This means that certain critical information—such as the tariff rate—is specific to the country importing the item.

The HS code was developed by the World Customs Organization and does not change from country to country. It is the “language” of international shipping. Finally this allows for all participating countries to identify a shipment despite not having a shared language.

HTS Codes vs Schedule B Numbers

When dealing with US international trade, there are two country-specific codes of note: HTS Codes and Schedule B Numbers. Both are crucial to the status of US international trade and economics but serve very different purposes.

The most important distinction comes in what they track.

Remember, HTS codes build upon global HS codes and monitor and identify shipments being imported into the country. HTS codes offer critical insight into the state of US national imports and are monitored by the U.S. International Trade Commission.

The picture wouldn’t be complete, however, without a method of tracking the country’s exports. And that’s where Schedule B Numbers come in.

Schedule B Numbers are not formed by HS codes and instead are administered by the U.S. Census Bureau, Foreign Trade Commission. It is design to track exports from the United States. Schedule B Numbers are specific to the United States and are used to compile the nation’s own export statistics. Because the information is designed for U.S.-use only, it does not rely on internationally-standardized HS codes. Instead, it uses a classification system designed by the U.S. Census Bureau, Foreign Trade Commission to track over 8,000 commodities that are exported each year.

The application of the data and the penalty for misuse also differ when comparing HTS codes and Schedule B Numbers.

Using the proper HTS code ensures expedient and cost-effective transport through customs. While reporting the correct Schedule B Numbers allows the Census Bureau to compile accurate information that can benefit industries.

Failing to use the correct HTS codes and Schedule B Numbers can lead to extra costs. Also this will delayed processing of imports and exports. So it’s imperative to follow standard procedures when reporting each number to the proper bureau.